Our mission is to unlock the unpriced value of

ecosystems and reimagine finance and governance that

recognizes nature as a shareholder, partner, and peacemaker.

For 3.8 billion years, nature governed life with resilience. In just 300 years, humans have governed by extraction—eroding the ecosystems that underwrite our economies. Symbaiosys exists to rewrite this story. We develop science-based data and new economy frameworks that shift ecosystems from “externalities” to shareholders and co-governors for a regenerative future.

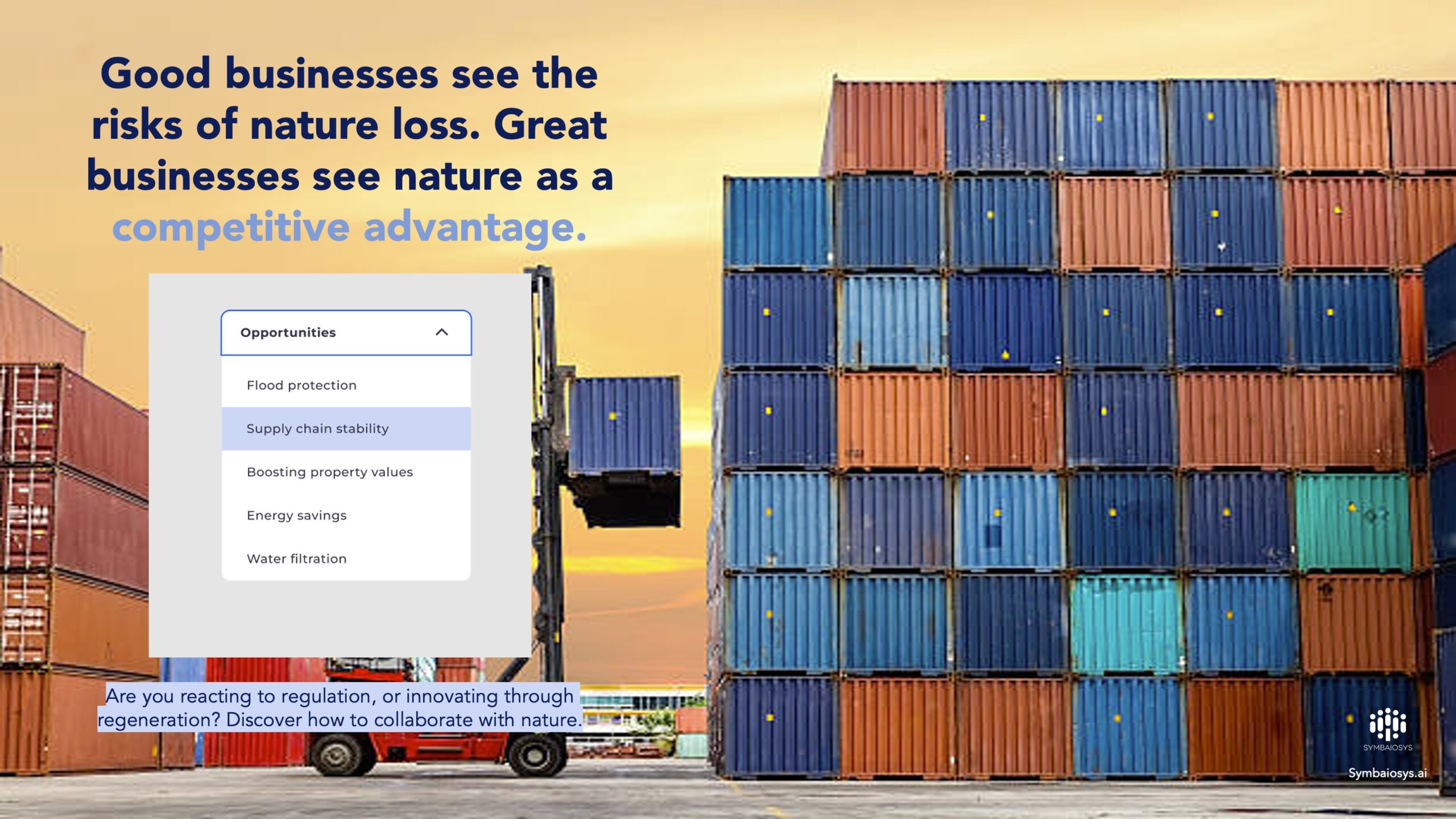

Symbaiosys designs reciprocal models that embed ecosystems into financial, governance, and peace infrastructures—focusing on nature opportunities. Our work spans three interrelated domains: Ecological Intelligence, Finance Studio, and Convergence—each building the tools, data, and frameworks for systemic transformation. All of our tools are aligned with leading global standards and classifications, including TNFD, TEEB, and Nature-based Solution (NbS) principles for interoperability.

Nature as Unpriced Risk

“Wildfires cost us $5B in settlements, wiping out 90% of our market value. Wetland restoration may have reduced our exposure, but we couldn’t justify the upfront costs without nature valuation data.”

– Chief Risk, Utilities Company

Nature as Infrastructure

“Restoring 100 hectares of seagrass costs $13M and generates $15M annually in avoided storm damages, water treatment costs and blue carbon storage. Why are we paying $50M for grey infrastructure?”

— Head of Infrastructure Investments, Asset Manager

Nature as Shareholder

“If 100 hectares of mangroves generate $5M annually in avoided flood damages, tourism and fisheries value, that’s $5M of shareholder equity nature has invested in underwriting our business. Like any shareholder, the mangroves are entitled to a vote and recurring dividends– anything less is a breach of fiduciary duty.

— Head of ESG Investments, Global Bank